Introduction

Business organizations have increasing pressures to behave ethically, and governments can play an important role in inspiring the private sector and civil society to have high standards of ethics. When corporations operate in a country with high levels of corruption in the public sector, or with relatively low commitment to fight corruption, this may lower the standards for the ethical behavior of firms. Businesses can be a source and a victim of corruption, but some enterprises are involved in actions to make the business environment more transparent and others are committed to improving ethical standards and fair practices in dealing with the public sector and enterprises (Sullivan, Wilson & Nadgrodkiewicz, 2013). For Kaufmann, Kraay and Mastruzzi (2007) there is a high correlation between corporate ethics and corruption in the public sector.

Corporate ethics and corruption in the public sector are very related to political structures. Countries with better governance, where authority is exercised for the common good, where the agents have confidence and respect the rules of the society, where governments implement sound policies and regulations that allow the private sector development, that have high levels of public services’ quality, that are politically stable, that promote political, civil and human rights, and are less corrupt create a sound business environment propitiator of higher standards of corporate ethics. When the public sector is corrupt there is little incentive to maintain high standards of business ethics.

Although in the economic literature there are several studies on corruption in the public sector and on business ethics (Chen & Aklikokou, 2019; Paulus & Kristoufek, 2015; Williams & Seguí-Mas, 2010) very few link the two, and to the authors' knowledge, this is the first attempt to group countries according to those indicators. In this context, this article aims to analyze the correlation between corporate ethics and corruption in the public sector, grouping countries according to their levels of the two indicators through a cluster analysis and examine, through statistical procedures, some economic and institutional characteristics of these clusters. The topic is important to better understand private-public sector interaction forming incentives to set corporate standards.

The article is organized as follows: first, the literature is reviewed. Then the research methodology is defined followed by the presentation and analysis of the results; and finally, conclusions and implications of this study are provided.

Literature review

To be competitive, economies must be able to favor an environment in which enterprises can create sustainable value. For the World Economic Forum (WEF) the institutional environment of a country is crucial for competitiveness and is determined by the efficiency and behavior of private and public institutions. Individuals, corporates, and governments interact in a legal and administrative framework that influences the quality of public institutions and affects a country's competitiveness and growth (WEF, 2017). As well, private institutions with high standards of ethics and transparency determine those achievements. In the Global Competitiveness Index (GCI) of the WEF the Ethical Behavior of Firms (EBF) is one of the indicators of the quality of private institutions.

Ethics “refers to well based standards of right and wrong that prescribe what humans ought to do, usually in terms of rights, obligations, benefits to society, fairness, or specific virtues” (Andre & Velasquez, 1987, p.1). Business ethics constitutes a branch of practical or professional ethics focused on exploring ethical principles and ethical or moral dilemmas occurring within the context of business operations. Business ethics may be perceived as a set of principles and moral standards that guide human behavior in businesses (Ferrell, Thorne & Ferrell, 2020). It extends across all facets of business behavior, encompassing the actions of both individuals and entire entities. Drawing from multiple business sources and areas of consensus, Lewis (1985) crafted a comprehensive definition: business ethics “is moral rules, standards, codes, or principles which provide guidelines for right and truthful behavior in specific situations” (p. 382). It involves the examination of situations, actions, and choices within business contexts that involve right and wrong considerations (Crane et al., 2019). Numerous interpretations exist for the concept of business ethics, and the controversies surrounding this field often arise from the understandings of what constitutes morality or ethics. To Crane et al. (2019), ethics involves the study of morality and the use of rational thinking to establish specific guidelines and principles that determine which actions are morally acceptable (and ethical theories serve as organized systems that outline the guidelines and principles), and morality refer to the standards, values, and beliefs woven into societal dynamics, determining what is deemed morally correct or incorrect for individuals or communities.

Business ethics involves behaving in ways that are honest, fair, and transparent, while respecting the rights and well-being of all those affected by their actions (Lewis, 1985; Schwartz, 2012). It means taking responsibility for the consequences of their decisions (accountability), complying with laws and regulations, and acting in a socially responsible way, demonstrating a long-term commitment to sustainability and social well-being (Lewis, 1985; Schwartz, 2012). Corporate Social Responsibility (CRS) operationalizes ethical principles through concrete actions and initiatives to enhance societal well-being and strengthen connections with stakeholders. Ultimately, ethical behavior in firms emphasizes values and responsible practices that benefit both the organization and society at large. CSR, ethical behavior of firms, and corruption in the public sector are interconnected concepts that shape the ethical and responsible conduct of businesses within the broader socio-economic context. CSR and ethical behavior of firms play a crucial role in preventing corruption, fostering transparency, and promoting responsible business practices.

Corruption can be defined as the “use of public office for private gain” (Gray & Kaufmann, 1998, p.7) and Transparency International publishes the Corruption Perception Index (CPI), widely used as an indicator of corruption, that scores countries based on how corrupt a country’s public sector is perceived to be.

Corruption is a phenomenon of dense relationships, in both the private and public sectors (Gault, 2017). In countries where the public sector is corrupt, this may spill over to the private sector, since corruption occurs in the interaction of agents. Also, strong corporate ethical values discourage unethical behavior and dishonesty (Tang et al., 2018). In countries with high levels of corruption and low ethical behavior, the cost of corruption may outweigh the benefit and corrupt practices spread among people.

Corruption can have high costs for society and has been a concern of some international organizations. With globalization, concern about this phenomenon has been intensified, since strategic alliances, mergers and acquisitions at the international level depend much more on mutual trust, and different levels of government and corporate ethics, and different regulations change the game’s rules, making the process more difficult. And in this century, we have experienced some crises at a global level, which have generally been framed as a failure of governance or ethics (Chun, 2019).

The study of behavioral ethics should involve contextual variables since people take into account the institutional, legal, economic, and social context to determine what is ethically right and wrong (Ekici & Onsel, 2013; Tang et al., 2018; Treisman, 2007; Xie, Qi & Zhu, 2019; Zhang, 2018).

Corruption can be understood as a weakness of the administrative system of the public sector and insufficient institutional capacity to perform the fundamental functions of governance and making political institutions more transparent can reduce corruption (Lindstedt & Naurin, 2005). The importance of corruption is based on the consensus that good governance is needed for countries to develop, and control of corruption is a key dimension of governance (Kaufmann et al., 2007). When there is good governance, that is, there is sound development management, with greater efficiency, transparency, and integrity, the control of corruption tends to be higher. Governance consists in “the traditions and institutions by which authority in a country is exercised” (World Bank, 2007, p. 2) and good governance is translated by the perception of representativeness of the "voices" of the different social strata, the capacity of the government to provide acceptable justifications for its decisions and actions taken in the name of the public good, political stability that contributes to minimize conflicts, increase economic agents’ confidence in governance, leaving less space for corrupt behavior. Also, complex regulations and week rule of law provide opportunities for corruption without punishment. Several authors show evidence that good governance reduces corruption (Kim, 2014; Serra, 2006; Xie et al., 2019; Zhang, 2018).

The ethical behavior of firms can also be influenced by political structures (Agyemang, Fantini, & Frimpong, 2015; Bota-Avram, 2013; Ferrell, Fraedrich, & Ferrell, 2011; Williams & Seguí‐Mas, 2010; Xie et al., 2019). Good governance promotes a sound business environment and a direction on ethical matters for the whole society (Ferrell et al., 2011). Enterprises must respond proactively to formal and informal institutional requirements to obtain resources that are fundamental to their development and success, and when regulatory framework is weak or there is political instability, government officials have greater discretionary power and corporates embark on strategies such as corruption to reduce uncertainty (Xie et al., 2019). Tang et al. (2018) in a study that incorporates micro and macro-level analysis, concluded that in countries with low corporate ethical values and high corruption in the public sector can be found the highest levels of dishonesty of managers with rent-seeking behaviors. For the authors, in highly corrupted countries the probability of getting caught for dishonesty is relatively low and corruption spreads among people.

In countries where there is a commitment to fight corruption, with regulatory quality and efficient rule of law, politically stable, with economic freedom, ensure not only individuals and politicians to behave ethically, but also enterprises to have higher standards of ethics (Agyemang et al., 2015). Zhou & Peng (2012) showed empirically that monetary resources spent by firms in bribing government officials are greater when there are higher policy uncertainty and lower quality of the legal system. Zhang (2018) investigated the links between public governance and corporate fraud in China and concluded that due to the enhanced public governance and anti-corruption campaign, firms were less likely to commit fraud. Agyemang et al. (2015), in a study for 39 African countries, found a significant and positive relationship between rule of law, regulatory quality, control of corruption and ethical behavior of firms, but not statistically significant for accountability and political stability. Boța-Avram (2013), based on an empirical investigation for 140 countries, suggests that for all the regions considered, the government effectiveness, the rule of law, and the control of corruption are the most influencing governance indicators on ethical behavior of firms.

It is also recognized that economic freedom can remove opportunities for corruption and promote ethics (Hall, Levendis & Scarcioffolo, 2020). An economically free country has small barriers to trade, can allocate resources freely through the market, has the protection of person and property, and enforced contracts (Prados de la Escosura, 2016). The strengthening of the protection of property rights and the quality of regulations is fundamental to improve ethical behaviors (Sullivan et al., 2013). Strong economic freedom is associated with lower government size dimensions, stronger legal structures, more flexible regulation of credit, labor, business, among others, and less conducive to unethical behavior. An individual is economically free if he can control the factors he owns, and therefore can make free decisions about working, producing, consuming, and investing. In any society, the search for special privileges creates social pressures to expand the size and weight of state intervention in the economy. When too much regulation restricts economic freedom, bureaucrats are more likely to have rent-seeking behavior, and individuals seek to bypass existing barriers. Several authors provide investigation in favor that economic freedom reduces corruption (Hall et al., 2020; Saha, Gounder & Su, 2009). Hall et al. (2020) assert that lower economic freedom benefits individuals who pursuit rent-seeking activities through corruption.

Corruption in the public sector and the standards of corporate ethics also can be related to economic development (Hall et al., 2020; Hauser, 2019; Jong-Sung & Khagram, 2005; Treisman, 2007). Paulus and Kristoufek (2015) clustered 134 countries concerning perceived corruption and found a strong connection between the levels of corruption and the stage of development. Investing in people, through education, health, decent standards of living, is fundamental to build human capital with a high standard of ethics. To Jong-Sung and Khagram (2005) income inequality undermines anti-corruption norms and fosters tolerance towards corrupt behavior by eroding belief in legitimate rules and institutions. To Lopes and Serrasqueiro (2017), culture and transparency in both private and public institutions are factors that affect knowledge transformation mechanisms and intellectual capital achievements.

The deep transformations in societies, resulting from the accelerated insertions of new Information and Communication Technologies (ICTs), have been a driving force for transparency. When the internet penetration rate is high, the easiness of disclosure of corruption cases and unethical behaviors is much higher, at a reduced cost and high speed (Jha & Sarangi, 2017). The Internet provides speedy means of sharing information with low costs and increases the risk of detection for political actors, civil servants, businesses, and civil society. In countries with greater access to information, corruption is lower (DiRienzo, Das, Cort & Burbridge, 2007; Jha & Sarangi, 2017). Theoretical studies suggest that ICTs enhances market transparency and reduces information asymmetry (Cheng, Chien & Lee, 2020) and can be an important force driving organizations to higher degrees of ethics (Bhattacherjee & Shrivastav, 2018). Also, the use of ICTs by governments, e-government, can provide efficient information management, promote more efficient services, enhance transparency and accountability, citizen participation and awareness, diminishing the discretionary power of officials, thus reducing corruption, and several studies reveal empirical evidence in favor of this relationship (Bhatnagar, 2014; Elbahnasawy, 2014; Lupu & Lazar, 2015; Nam, 2018; Srivastava, Teo, & Devaraj, 2016). Nam (2018), found evidence that e-Government development contributes to reducing corruption, and this impact is influenced by the political, economic, and cultural conditions of countries. Nevertheless, Bhatnagar (2014) argues that e-Government systems can have weaknesses that allow corrupt behaviors. E-government is not neutral in terms of governance and can, mainly in developing countries, improve administrative capacity, democratic governance, and over and above, has political and sociological effects such as transparency, openness, and limit corruption (Stanimirovic & Vintar, 2013).

Research methodology

Hypotheses

In this research, the focus is on the relationship between corporate ethics and corruption in the public sector, to cluster countries. Several economic, institutional, political, and development indicators were collected to characterize the clusters.

The hypotheses under investigation are:

H1 - Corporate ethics and corruption in the public sector are highly correlated.

H2 - Economies can be classified in groups according to their levels of ethical behavior of firms and the perception of public corruption, where groups of economies that have high levels of corruption also have low standards of corporate ethics and the countries with low corruption also have high standards of corporate ethics.

H3 - Higher standard of corporate ethics and low perception of corruption in the public sector is observed in countries: H3.a) with a high degree of economic and human development: H3.b) more economically free; H3.c) with better governance; H3.d) with a high degree of digitalization; and H3.e) with strong systems of corporate accountability.

Methodology

To attain the objectives and validate the hypotheses, the research methodology underwent three phases: Spearman’s correlations were discussed, the countries were classified using cluster analysis, and statistical measures for each cluster were computed including Kruskal-Wallis test regarding several economic, institutional, political and development indicators.

The objective of the cluster analysis was to identify subgroups of countries with differentiating standards of ethics in firms and perceptions of corruption in the public sector. First, hierarchical clustering was used to determine the appropriate number of clusters, followed by a k-means clustering to establish the final cluster membership. ANOVA was applied to examine how well the used variables discriminate among clusters. Scheffe post-hoc tests were also performed to check for significant differences in the groups.

Data

Data were collected from 2008 to 2017 and the average values in this period were used to avoid specific or temporary shocks in a particular year that could influence the scores of a country. The sample is formed by 127 countries for which all the necessary information was available and includes 92 emerging and developing countries, 28 advanced economies, and 7 major advanced economies, according to the classification of the International Monetary Fund. 13.3% are low-income economies, 21.3% lower middle income, 26% upper middle income, and 39.4% high-income economies, which is very similar to the percentages observed in the world (15.5%, 21.6%, 25.7%, and 37.2%, respectively).

Corporate ethics is measured by the ethical behavior of firms, one of the indicators of the GCI published by the WEF. The GCI evaluates the factors and institutions that determine improvements in productivity, enabling economies to achieve sustainable economic growth and prosperity. The institutional environment is of fundamental importance to competitiveness and to create wealth, and in the first pillar - Institutions - the GCI includes not only public institutions but also private since both are important elements in that process. As referred by Sala-i-Martin et al. (2007, pp. 4-5) about the private institutions “An economy is well served by businesses that are run honestly, where managers abide by strong ethical practices in their dealings with the government, other firms, and the public”, and that “Private-sector transparency is indispensable to business, and can be brought about through the use of standards and auditing and accounting practices that ensure access to information in a timely manner”. The EBF is included in this pillar and derives from the Executive Opinion Survey, “the longest-running and most extensive survey of this kind” (WEF, 2017, p. 333) centrally managed by the WEF, and conducted by Partner Institutes (recognized academic/research and professional organizations worldwide), chosen for their reach to business leaders, national insight, and commitment. These Institutes follow precise sampling guidelines to ensure representative and comparable data across different economies, capturing the views of more than 12,000 business executives from micro to large companies across sectors. EBF is measured by the responses to the survey question “In your country, how would you rate the corporate ethics of companies (ethical behavior in interactions with public officials, politicians, and other firms)?. It is rated from 1- extremely poor (among the worst in the world) to 7- excellent (among the best in the world) (WEF, 2017). Although EBF is a categorical variable, in this paper, the average of the values observed from 2008 to 2017 for each country is being used, which results in a quantitative variable.

Corruption in the public sector is measured by the Corruption Perceptions Index (CPI) by Transparency International, that estimates the degree to which corruption is perceived among public officials and politicians, and ranges from 0 (highly corrupt) to 100 (highly clean). The lower the score, the higher the corruption.

For each cluster, some features were analyzed, and their correlations with CPI and EBF, as indicators of economic development; indicators of good governance; economic freedom; the degree of use of ICTs; e-government; and accountability in corporations.

Economic development refers to the sustained improvement in the standard of living, well-being, and overall quality of life for a country's population, and involves a wide range of dimensions which interact with each other that cannot be easily captured by a single indicator.

Economic development can be narrowly characterized as the measurement of a country's progress through its per capita real GDP and is frequently employed to compare the economic well-being of countries (Dědeček & Dudzich, 2022; Paulus & Kristoufek, 2015; Pearce, Atkinson & Dubourg, 1994; Treisman, 2007). However, it has several limitations that can affect its accuracy and comprehensiveness in capturing economic development (Dědeček & Dudzich, 2022). GDP per capita does not consider the distribution of income within a country and a high GDP per capita might disguise significant disparities in wealth and living standards among different segments of the population. Assessing the development of a country involves analyzing the importance of people and their capabilities and GDP per capital also does not take account human well-being like life expectancy and educational attainment. Taking the aforementioned into account, several indicators such as income inequality, human capital, and human development were employed.

The Gini coefficient was used to analyse income inequality and ranges from 0 to 1, where 0 represents perfect equality and 1 represents perfect inequality (obtained from Our World in Data). Human Capital is measured by the Human Capital Index from the World Bank (WB) and is the amount of human capital that a child born today can expect to attain by the age of 18, and highlights how improvements in current health and education outcomes shape the productivity of workers. It ranges from 0 to 1, and a higher value means a better performance. The Human Development Index, from the United Nations, is a measure of achievements in three key dimensions of human development: a long and healthy life, access to knowledge, and a decent standard of living. The Human Development Index ranges from 0 to 1 since it is the geometric mean of normalized indices for each of the three dimensions.

The Index of Economic Freedom of the Heritage Foundation and the Wall Street Journal is a good indicator to assess the degree of public intervention in the economy, paying particular attention to arbitrary regulation and it is used to measure rent-seeking activity. This indicator contains information on the degree of public intervention on business, international trade, capital flows, taxes, property rights, labor, and corruption, among others, and complements the previous analysis. The index is on a scale of 0 to 100, and a higher score denotes more economic freedom.

The legal and regulatory framework establishes “the minimum standards of acceptable conduct in doing business, and reflects what society holds as fair and appropriate behavior by all types and sizes of firms” (Sullivan et al., 2013, p.7). Good governance is measured by the Worldwide Governance Indicators, developed by Kaufmann, Kraay and Zoido-Lobaton (1999) to the WB: Voice and Accountability, that capture the perceptions of the extent to which a country’s citizens are able to participate in selecting their government, as well as freedom of expression, freedom of association, and a free media; Political Stability, that measures the perceptions of the likelihood of political instability and/or politically-motivated violence, including terrorism; Government Effectiveness, that captures the perceptions of the quality of public services, the quality of the civil service and the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government’s commitment to such policies; Regulatory Quality, that captures the perceptions of the ability of the government to formulate and implement sound policies and regulations that permit and promote private sector development; and Rule of law, that captures the perceptions of the extent to which agents have confidence in and abide by the rules of society, and in particular the quality of contract enforcement, property rights, the police, and the courts, as well as the likelihood of crime and violence. These indicators range approximately from -2.5 to 2.5, with higher scores denoting better government performance.

The use of ICTs is measured by the percentage of individuals using the Internet, by the WB, and the Internet can be used via a computer, mobile phone, personal digital assistant, games machine, digital TV, among others. E-government is measured by the e-Government Development Index and e-Government Participation, from the United Nations, and are the weighted average of normalized scores of important dimensions. The e-Government Development Index measures the readiness and capacity of national institutions to use ICTs to deliver public services. The e-Participation Index focuses on the dimension of the use of online services to facilitate the provision of information by governments to citizens, interaction with stakeholders, and engagement in decision-making processes.

Corporate Accountability was gathered from the WEF and it is the perception of the strength of auditing and reporting standards, efficacy of corporate boards, protection of minority shareholders’ interests and strength of investor protection.

Results

Levels of corruption perceptions index and corporate ethics

The analysis of the CPI reveals that from the 127 countries of the sample about 67% have scores under 50, with a mean of 46. These figures are similar for the EBF, since 57% rate it under 4, with a median of 3.91. The Spearman’s correlation coefficient (ρ=0.82, significant at 0.01 level) also suggest a very strong and positive correlation between the CPI and EBF, which confirms the first hypothesis. The maps of the distribution of the EBF and CPI by countries are very similar (Figure 1, Figure 2).

Source: own ellaboration based on data from WEF

Figure 1 Distribution of the ethical behavior of firms (mean 2008-2017)

Source: own ellaboration based on data from Transparency International

Figure 2 Distribution of the corruption perceptions index (mean 2008-2017)

By level of income, according to the classification of the WB, there are slight differences in the distribution of the CPI and the EBF (Figure 3 and Figure 4). While the median of CPI is higher as the level of income increases, this trend is not so visible for the median rate of EBF, since countries with low income, lower-middle and upper-middle incomes have almost the same median. Nevertheless, in high-income countries, the median standard of corporate ethical behavior is very high. It should be noted that, although corruption is lower and the rate of EBF higher in rich countries, the minimum value for EBF is not very different among countries with different levels of income. In low-income countries, Rwanda appears as an outlier with higher scores of CPI (47.08) and EBF (5.15), and Botswana, an upper-middle-income country, registered a CPI of 60.88.

Cluster analysis

Through a cluster analysis, the countries were grouped according to the two variables under analysis. It was applied a hierarchical cluster analysis, with the nearest neighbor method using the squared Euclidean distance as a measure of dissimilarity among the countries. After the analysis of the dendrogram, the final number of clusters to retain was decided using the R2 as described in Marôco (2018). The lowest number of clusters was chosen, which retained a considerable fraction of the total variance (about 80%). Three clusters were retained that explain 80.28% of the total variance. The classification of each country in the retained clusters was refined using the non-hierarchical k-means procedure. The Variance Inflation factor between these two variables is 6.075, which being less than ten, means that there is no serious multicollinearity problem. Table 1 displays, for the three clusters identified, the final centers for the CPI and EBF and the results of ANOVA tests. The analysis of the F-value of a one-way ANOVA allows us to conclude that all clustering variables’ means differ significantly (p-value<0.05).

Table 1 Results of the cluster analysis (final centers) and ANOVA

|

|

|

|

ANOVA | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Cluster | Error | F | Sig. | ||||||

| Mean Square | df | Mean Square | df | ||||||

| Corruption Perceptions Index | 49.88 | 30.28 | 79.05 | 23038.98 | 2 | 40.66 | 124 | 566.61 | 0.000 |

| Ethical behavior of firms | 4.23 | 3.56 | 5.75 | 45.88 | 2 | 0.179 | 124 | 256.42 | 0.000 |

Source: own ellaboration

According to results, cluster 3 comprises 27 countries and corresponds to the group with the lowest mean levels of corruption and highest corporate ethical behavior, while cluster 2, with 65 countries, includes the countries with the highest mean levels of corruption and lower mean standards of ethical business behavior, which is also observable in Figure 5. Cluster 1 includes 35 countries and has medium mean scores for CPI and EBF. The countries in each cluster are reported in Annex A1. Table 2 reports the Euclidean distances among the final cluster centers, showing that there are great dissimilarities among the three clusters and that cluster 2 and 3 are the most different ones. These results confirm the second hypothesis.

Source: own elaboration

Figure 5 Corruption perceptions index and ethical behavior of firms by cluster

Table 2 Distances between final cluster centers

| Cluster | 1 | 2 | 3 |

|---|---|---|---|

| 1 | 19.61 | 29.21 | |

| 2 | 19.61 | 48.82 | |

| 3 | 29.21 | 48.82 |

Source: own ellaboration

The variables EBF and CPI were divided into three bins of equal length and classified in Low, Medium and High levels and the clusters were analyzed based in this classification (Table 3). In cluster 3, almost all countries have high CPI (96.3%) and high EBF (85.2%), while in cluster 2, 68% of the countries have low CPI and 79% low EBF. Cluster 1 includes countries with medium CPI (100%) and medium EBF (74%).

Table 3 Composition of the clusters by the level of EBF and CPI

| % within Cluster Number of Case | Cluster 2 Low CPI & EBF | Custer 1 Medium CPI & EBF | Cluster 3 High CPI & EBF | |

|---|---|---|---|---|

| Ethical behavior of firms (Binned) | Low EBF | 78.5% | 25.7% | 0.0% |

| Medium EBF | 21.5% | 74.3% | 14.8% | |

| High EBF | 0.0% | 0.0% | 85.2% | |

| Corruption Perceptions Index (Binned) | Low CPI | 67.7% | 0.0% | 0.0% |

| Medium CPI | 32.3% | 100.0% | 3.7% | |

| High CPI | 0.0% | 0.0% | 96.3% |

Source: own ellaboration

The analysis of the composition of the clusters also reveals that cluster 3, which has the best performance in corporate ethics and transparency in the public sector, is formed only by countries with high income (Table 4). This may be because rich countries have more resources to fight corruption and, as Seldadyo and Haan (2006) suggest, corruption behaves as an inferior good: the higher is the income, the lower is the demand. But corruption and unethical corporate behavior is also a problem in rich countries since 5% of the countries with low performance in both indicators (Cluster 2) are rich countries and 35% have upper middle income. In cluster 2, with medium performance, also 57% of the countries have high incomes (Figure 6).

Table 4 Classification of countries in each cluster according to the level of development and income

| Cluster 2 | Cluster 1 | Cluster 3 | |

|---|---|---|---|

| Major advanced economies | 0.0% | 2.9% | 22.2% |

| Advanced economies | 0.0% | 34.3% | 59.3% |

| Emerging and developing countries | 100.0% | 62.9% | 18.5% |

| High income | 5% | 57% | 100% |

| Upper middle income | 35% | 29% | 0% |

| Lower middle income | 35% | 11% | 0% |

| Low income | 25% | 3% | 0% |

Source: own ellaboration

Source: own elaboration

Figure 6 Scatter plot of corruption perception index vs. ethical behavior of firms by the degree of development in each cluster

It is also noticeable that high levels of ethics and low corruption is not only observed in the most advanced or advanced economies but also in emerging and developing countries. Nevertheless, Italy, classified as a major advanced economy, along with 12 advanced economies (Portugal, Spain, Greece, Cyprus, Lithuania, Latvia, Malta, Slovenia, the Slovak Republic that belong to the euro area and the Czech Republic from European Union, South Korea and Israel) are part of cluster 2, with medium ethical behavior and corruption (Figure 7).

Source: own elaboration

Figure 7 Scatter plot of corruption perception index vs. ethical behavior of firms by the level of income in each cluster

Most of the countries in cluster 2 are from Sub-Saharan Africa, Americas (all from Latin America and the Caribbean), and the Asia Pacific, while in cluster 3 are from Western Europe/European Union (Table 5).

Table 5 Region of countries in each cluster

| Cluster 2 | Cluster 1 | Cluster 3 | |

|---|---|---|---|

| Middle East and North Africa | 6.2% | 20.0% | 7.4% |

| Americas | 27.7% | 2.9% | 18.5% |

| Western Europe/European Union | 1.5% | 42.9% | 55.6% |

| Asia Pacific | 20.0% | 5.7% | 18.5% |

| Europe and Central Asia | 13.8% | 8.6% | 0.0% |

| Sub-Saharan Africa | 30.8% | 20.0% | 0.0% |

Source: own ellaboration

Table 6 reports the mean value and standard deviation of the variables used to analyze the features of the countries in each cluster. Kruskal-Wallis tests were used to examine differences among clusters concerning these features, the results of the Chi-Square test and the Spearman’s correlation coefficients (ρ) are also reported in the table. The results of the Kruskal-Wallis tests in Table 6 show that there are statistically significant differences among clusters (p-value<0.05) for all the variables considered. To understand where the differences occur between the three clusters, the Scheffe post-hoc test was performed for all the variables and the results obtained denoted statistically significant differences among the three groups (p-value<0.001).

Table 6 Characteristics of the clusters based on mean, standard deviation, and chi-square tests

| Cluster 2 | Cluster 1 | Cluster 3 | Chi-Square Test | Spearman’s rho | |||||

|---|---|---|---|---|---|---|---|---|---|

| Low CPI & EBF | Medium CPI & EBF | High CPI & EBF | |||||||

| Mean | SD | Mean | SD | Mean | SD | CPI | EBF | ||

| Gini coefficient | 0.40 | 0.017 | 0.38 | 0.017 | 0.32 | 0.010 | 18.19** | -0.352** | -0.271** |

| Human capital index (HCI) | 0.51 | 0.11 | 0.62 | 0.13 | 0.71 | 0.09 | 60.28** | 0.748** | 0.581** |

| Human Development Index | 0.63 | 0.12 | 0.76 | 0.11 | 0.85 | 0.05 | 79.31** | 0.811** | 0.640** |

| Index of Economic Freedom | 56.98 | 6.87 | 65.02 | 5.40 | 73.94 | 3.92 | 24.10** | 0.850** | 0.749** |

| Government Effectiveness | -0.47 | 0.44 | 0.46 | 0.48 | 1.16 | 0.57 | 95.03** | 0.946** | 0.807** |

| Political Stability | -0.64 | 0.63 | 0.22 | 0.70 | 0.77 | 0.08 | 73.66** | 0.807** | 0.643** |

| Regulatory Quality | -0.37 | 0.49 | 0.53 | 0.48 | 1.30 | 0.59 | 90.19** | 0.919** | 0.758** |

| Rule of Law | -0.63 | 0.36 | 0.41 | 0.41 | 1.29 | 0.54 | 102.14** | 0.966** | 0.820** |

| Voice and Accountability | -0.41 | 0.60 | 0.32 | 0.80 | 0.14 | 0.72 | 56.69** | 0.755** | 0.475** |

| Individuals using the Internet (%) | 25.50 | 17.64 | 50.82 | 21.33 | 71.28 | 17.90 | 79.41** | 0.814** | 0.665** |

| E-Government Development | 0.40 | 0.14 | 0.59 | 0.13 | 0.77 | 0.08 | 75.72** | 0.801** | 0.638** |

| E-Participation Index | 0.27 | 0.15 | 0.40 | 0.17 | 0.62 | 0.20 | 45.38** | 0.646** | 0.578** |

| Corporate accountability | 4.12 | 0.41 | 4.62 | 0.44 | 5.32 | 0.13 | 70.14** | 0.786** | 0.864** |

Note. SD - Standard Deviation; ** - significant at 0.01 level

Source: own ellaboration

The results suggest that better performance in corporate ethics and transparency in the public sector are observed in countries with better economic development - a fairer distribution of income, higher human capital, and human development confirming hypothesis 3.a). The knowledge, skills and wealth that people accumulate are correlated positively with ethics. A negative correlation is also observed between the Gini coefficient and EBF and CPI, indicating that higher income inequality is associated with lower levels of business ethics and higher levels of corruption. This last conclusion corroborates the findings of Jong-Sung and Khagram (2005).

The Index of Economic Freedom provides a framework for understanding the trade policy, the degree of government intervention in the economy through taxation, spending or overregulation; and the strength and independence of a country’s judiciary system to enforce rules and protect private property. Likewise, in countries where there is greater economic freedom - which is associated with sound legal structures, more flexible regulations - there is a greater likelihood that behavior will be less corrupt or more ethical, which confirms hypothesis 3.b). There is a very strong and positive correlation between economic freedom and CPI (ρ=0.85) and strong with corporate ethics (ρ=0.75), significant at 0.01 level (Figures 8 and 9).

Source: own elaboration

Figure 8 Scatter plot of corruption perceptions index vs. economic freedom by cluster

Source: own elaboration

Figure 9 Scatter plot of ethical behavior of firms vs. economic freedom by cluster

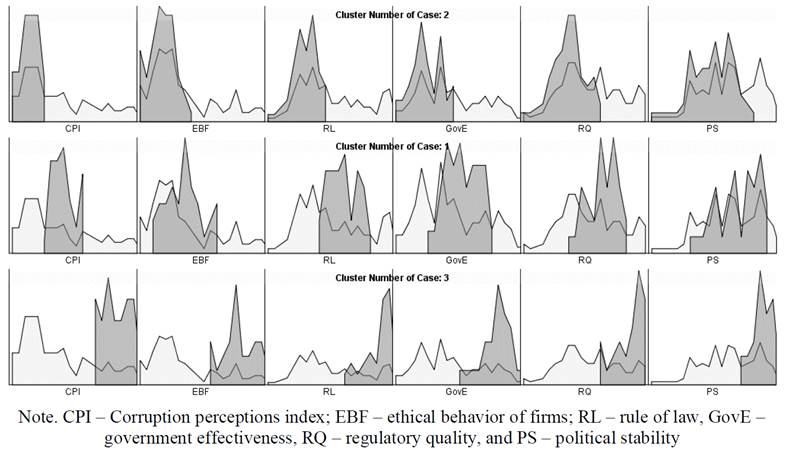

On what good governance is concerned, Corporate Ethics has a very strong and positive correlation with Rule of Law and Government Effectiveness (ρ=0.82 and 0.81, respectively), strong with Regulatory Quality and Political Stability (ρ=0.76 and 0.64) and moderate with Voice and Accountability (ρ=0.48), all significant at 0.01 level. Also, CPI has a very strong and positive correlation with Rule of Law, Government Effectiveness, Regulatory Quality, and Political Stability (ρ=0.97, 0.95, 0.92, and 0.81, respectively) and strong with Voice and Accountability (ρ=0.76). As can be seen in Figure 10, the performance of Rule of Law, Government Effectiveness, Regulatory Quality, and Political Stability is very different in the three clusters. In cluster 3, with high levels of corporate ethics and transparency in the public sector, countries have efficient legal systems, public services with high quality and independent from political pressures, formulate and implement sound policies and regulations that promote the private sector development and are politically stable. This good performance on the governance of public administrations enhances the ethical standards, either private or public (hypothesis 3.c)

Source: own elaboration

Figure 10 Comparing clusters for rule of law, government effectiveness, regulatory quality, and political stability

An environment of information, namely through the use of ICTs by public and private actors, can spread the power of knowledge, reducing space for unethical behaviors. Higher rates in the use of the Internet by individuals are observed in clusters with high corporate ethical behavior and lower corruption (Table 6). Figure 11 depicts the distribution of Internet users by cluster. In cluster 2 the percentage of individuals using the Internet range from a minimum of 2% (Burundi) to a maximum of 58% (Azerbaijan), in cluster 1 between 10% (Rwanda) and 86% (Korea) and in cluster 3 between 54% (Uruguay) and 96% (Iceland). Furthermore, in 25% of the countries in cluster 2 the percentage of individuals using the Internet only reaches 11.5%, while in cluster 3 it is 76.9%. Chile and Uruguay, in cluster 3, register percentages in the use of the Internet lower than the remaining countries. The correlation between the Internet and the Corruption Perceptions Index is very strong (ρ=0.81) and moderate with corporate ethics (𝜌=0.67), and significant at the 0.01 level.

Also, the capacity of public institutions to use ICTs to deliver public services and interact digitally with people is very important for transparency and fairness. The use of digital technologies and innovations by the government and open and participatory governance through ICTs can potentially reduce the scope for corruption, private and public. Table 4 and Figures 12 and 13 show significant differences in e-government development and e-participation among the three clusters, denoting that clusters with e-government development and e-participated systems are more ethical and transparent. In cluster 1, South Korea is an outlier, presenting e-government development and e-government participation indexes higher than the other countries. On the contrary, Barbados and Qatar included in cluster 3 have an e-government development lower than the remaining countries included in this group.

These results confirm the hypothesis that a higher standard of corporate ethics and low perception of corruption in the public sector are observed in countries with a high degree of digitalization (H3.d).

Corporate Accountability has a very strong positive correlation with the business ethics of firms and strong with the Corruption Perceptions Index (0.86 and 0.79, respectively), significant at 0.01 level. As it can also be seen in Table 6, the ethical standards are higher when the countries have strong accountability systems, resulting from the strength of auditing and reporting standards, the efficacy of corporate boards, the protection of minority shareholders’ interests and the strength of investor protection, confirming hypothesis 3.e).

Conclusions

Ethical behavior of firms and the public sector is fundamental in a globalized world and are shaped by economic, institutional, and political structures. Most studies in this area either focus on the causes and/or the effects of corporate ethical behavior or corruption. Nevertheless, corporate ethics and corruption in the public sector have spillover effects on each other. Thus, the objective of this article was to analyze the relationship between corporate ethics and corruption in the public sector worldwide, using the indicator of EBF from the WEF and the CPI of Transparency International, through cluster analysis. Some authors have adopted cluster analysis but in different contexts either for corporate ethics (Williams & Seguí-Mas, 2010) or corruption in the public sector (Chen & Aklikokou, 2019; Paulus & Kristoufek, 2015).

This article adds value to the current literature since, to the best of our knowledge, it is the first one in clustering countries through statistical procedures by linking their level of public corruption and corporate ethics, ascertain the performance of each cluster on several economic, institutional, political, and development indicators and analyze the significant statistical differences between clusters. Thus, this article presents a categorization of countries, in an attempt to assess the current state of corporate ethics and public sector corruption worldwide, facilitating the comparison, and going further than current studies.

The results of this study suggest that the standards of corporate ethics and the level of corruption are very correlated, and it was possible to group the 127 analyzed countries in three clusters, which suggest that countries worldwide can be aggregated in different groups according to the levels of corruption in the public sector and corporate ethics. The findings reveal that a high level of corporate ethics is associated with low levels of corruption, and the clusters have different performances in several indicators.

Data presented in this paper reveal that countries with high levels of corporate ethics and low corruption have more economic freedom, less income inequality, enhanced human capital, and human development. To Hauser (2019) regular training of employees is one of the most effective ways to prevent corruption and in a globalized world this can help to avoid corruption in more corrupt countries. They also have better public governance, higher e-government development, e-government participation, and higher corporate accountability.

When the Internet penetration rate is high, the easiness of disclosure of corruption cases and non-ethical behaviors is much higher, since it provides speedy means of sharing information with low costs and increases the risk of detection. In the sample, higher levels of corporate ethics and lower perception of corruption were observed in countries with a high percentage of individuals using the Internet and these results support some previous studies (Bhattacherjee, & Shrivastav, 2018).

One of the limitations of this investigation is that the cluster analysis relies on survey-based variables and assessments of experts and business people (Corruption Perception Index and Ethical Behavior of firms), introducing potential measurement errors due to subjective perceptions and contextual differences. However, this limitation is common in cross-country studies, and data are derived from reputable sources and their usefulness cannot be dismissed (Boța-Avram, 2013; Guidara, 2022).

The results of this study provide further support for researchers who assert that corporate ethics or corruption in the public sector varies among countries based on their political, legal, or economic factors (as Ekici & Onsel, 2013; Zhang, 2018; Chun, 2019). In future investigation, it will be important to identify the shared factors influencing the ethical conduct of firms and the occurrence of corruption using alternative methodological approaches. While the current study employed cluster analysis, which is a classification method for categorizing countries that share similar characteristics based on distance measures, which was the objective of this study, it does not allow quantifying the relationship between variables. The use of regression models enables to predict and quantify relationships between variables in various fields, or the use of Structural Equation Models that facilitates theory testing, model evaluation, understanding and quantifying complex relationships (direct and indirect effects), and advance our understanding of how variables interact in various domains. Research could explore how cultural norms, political regime and socio-economic factors impact the ethical conduct of firms and the prevalence of corruption. It would also be important to focus on the ethical challenges and corruption dynamics faced by firms operating in emerging markets and study strategies for dealing with ethical dilemmas in different cultural, political and regulatory environments, as well as the impact that unethical behaviour by companies (namely monopolies and transnational corporations) could have on corruption of the public sector and development of these countries.

The characteristics of the private and public sectors are different, but it is imperative that both of them should be oriented by transparency and morality, and the public sector should even serve as a role model. Good governance by the public sector is crucial to enhance corporate ethics and reduce corruption. The existence of market-friendly policies, the transparency in the communication of decisions and actions taken by the government in the name of the public good, political stability, and an effective justice system seem to contribute to the honesty of bureaucrats and politicians and be an example for the whole society, enhancing the ethical standards in both private and public institutions. The findings of this article can be used by the public and private sector leaders to design ethical policy frameworks and strategies to improve ethical behavior.

nueva página del texto (beta)

nueva página del texto (beta)